Car Accident Insurance Claims: What You Need to Know After a Crash

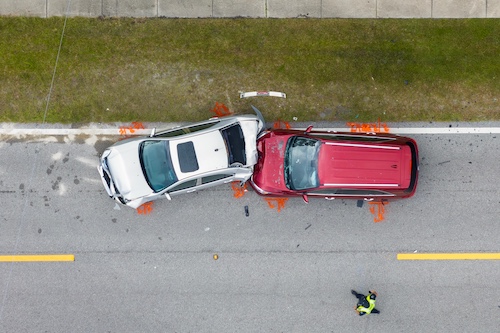

Car accident insurance claims can feel overwhelming after a crash, especially when you’re injured, your vehicle is damaged, and bills are piling up. The steps you take early can affect your ability to recover money for repairs, medical treatment, and lost income.

In this blog, we break down the car accident insurance claims process, outline your rights under Tennessee law, and explain how working with an experienced Knoxville car accident attorney can help you recover full compensation after a crash.

Immediate Steps After a Car Accident

After a car accident, your actions at the scene and shortly after can affect your car accident insurance claims and legal options. Follow these steps to protect your health, your rights, and your claim.

Check for Injuries and Call for Help

First, check yourself and others for injuries. If anyone is hurt, call 911 right away. Emergency medical attention is the priority. Even if injuries seem minor, request evaluation by paramedics. Some injuries take time to show symptoms.

Move to Safety and Prevent Further Accidents

If the vehicle can be moved, drive it to the side of the road. Turn on hazard lights to warn other drivers. This reduces the risk of a second car crash. Stay at the scene and remain calm.

Call the Police and File a Report

Tennessee law requires you to report accidents involving injury, death, or property damage over $1,500. File a police report at the scene. Get the responding officer’s name, badge number, and the incident number. The police report is a key part of the insurance claims process and helps determine fault.

Exchange Information With the Other Driver

Get the other driver’s full name, phone number, license plate number, and car insurance details. Share your own insurance card and driver’s license. If there are witnesses, ask for their contact information. Do not admit fault or speculate about what happened.

Take Photos and Document the Scene

Use your phone to take clear photos of vehicle damage, skid marks, road conditions, and injuries. Upload photos later when you file a claim online or speak with the insurance adjuster. These images help support your auto insurance claim and show how the accident occurred.

Notify Your Insurance Company

Contact your local agent or file an auto claim online as soon as possible. Give your insurer the police report number, contact details of the other driver, and photo evidence. Provide a short and factual account of what happened. This begins the car insurance claim and allows your insurer to start the investigation.

Seek Medical Attention

If you did not receive treatment at the scene, visit a doctor as soon as possible. Some injuries do not appear until hours or days later. Keep records of your treatment. Submitting bills and medical reports is part of the claims process, especially for personal injury compensation.

Stay Organized and Keep Records

Save all paperwork related to the accident. This includes repair estimates, rental car receipts, medical bills, and claim numbers. Track all communication with the insurance company. Accurate records help if you need a car accident lawyer later.

Filing Your Car Accident Insurance Claim

Filing your car accident insurance claim the right way helps protect your legal rights and improves your chances of fair payment for repairs, medical bills, and other losses.

Notify Your Insurance Company Quickly

Call your insurance company or local agent as soon as possible. You can also file a claim online through the insurer’s website or app. Give them clear facts about the accident, including the date, time, location, and names of everyone involved. Delays in reporting may affect your coverage or cause the company to deny the claim.

Provide All Required Information

Submit the police report number, photos from the accident scene, and insurance details from the other driver. Include any medical records, repair shop estimates, or rental car receipts. Make sure everything you send is complete and accurate. This helps move the claims process forward without delays.

Understand Your Policy and Coverage

Review your car insurance policy to check your deductible, limits, and coverages. Look at whether your plan covers rental cars, roadside service, or medical expenses. Tennessee is a fault state, meaning the at fault party is responsible for damages. If the other driver is at fault, their insurance company may be required to pay.

Be Cautious When Speaking to the Other Driver’s Insurance Company

If the other driver’s insurer contacts you, be careful. Do not give a recorded statement without advice from a car accident attorney. Insurers often use statements to reduce or deny your car accident claim. Keep your answers short and factual. You are not required to explain injuries or vehicle damage in detail.

Watch for Insurance Adjuster Requests

An insurance adjuster may ask to inspect your vehicle or review your medical records. You can choose your own repair shop under Tennessee law. Make sure any inspection happens at a location you trust. You are not required to accept the first settlement offer. If the offer is too low, speak with a car accident lawyer.

Track Your Claim and Stay in Contact

Follow up with your insurance company to check the claim status. Write down the names of every adjuster or representative you speak with. Keep copies of all messages, letters, and payment summaries. Good records can protect you if problems come up during the auto insurance claim process.

Handling Insurance Adjusters & Damage Evaluations

After filing your car accident insurance claim, you will work with an insurance adjuster who will inspect your vehicle and review your losses. Knowing how to manage this part of the claims process helps you avoid costly mistakes.

Understand the Role of the Insurance Adjuster

An insurance adjuster works for the insurance company, not for you. Their job is to review the damage, estimate repair costs, and decide how much the company will pay. They will look at the police report, photos, and other evidence you provided. Keep in mind that their goal is to save the insurer money, not to make sure you receive the full value of your car accident claim.

Get a Second Opinion on Repairs

You have the right to use your own repair shop. Do not feel pressured to use the shop recommended by the insurer. Get at least one independent estimate for vehicle repairs. Compare the cost to the adjuster’s estimate. If there is a big difference, show the insurer the extra details or photos from your chosen shop.

Know Your Car’s Actual Cash Value

If your car is totaled, the insurance company will pay the vehicle’s actual cash value. This means the market value before the crash, not the replacement cost. If you believe the offer is too low, provide sales listings or appraisals to support a higher value. A car accident attorney can help you dispute the payment if needed.

Handle Rental Car Costs

If your policy includes rental car coverage, the insurance company will pay for a vehicle while yours is being repaired. If the other driver is at fault and their insurer accepts responsibility, they may be required to pay. Keep receipts and confirm how long the rental is covered under your policy or their policy.

Stay in Control of the Process

Ask questions if something does not make sense. Do not accept the first settlement if it does not cover all your costs. Review every payment or offer carefully. A car accident lawyer can review the terms and help you get more money if the insurance company undervalues your claim.

The Legal Edge: When to Hire a Knoxville Car Accident Lawyer

A car accident can trigger complex issues with injury, fault, and insurance. You may need help from a car accident lawyer at key moments.

You Are Injured or Face Major Damages

You should consider hiring our car accident attorney when injuries require medical care, hospitalization, surgery, or long-term therapy. You may face high medical bills, vehicle repairs, lost wages, or future expenses. We at Knoxville Car Accident Lawyer have seen these hidden damages first hand, and we know insurance companies may underpay or deny claims.

Fault Is Disputed or Complex

If you are not sure who caused the accident, or the other driver’s insurance company disputes fault, the situation can become difficult. Fault decisions affect your ability to recover. Tennessee uses modified comparative negligence, where you cannot recover if you are 50 percent or more at fault. We work to gather evidence, police reports, witness statements, and expert opinions to prove who is responsible.

The Other Driver’s Insurance Company Contacts You

An insurance adjuster may call and ask for a recorded statement. They may seem helpful. They may also push you into a quick, low settlement. This initial offer may not cover total costs of medical care, repairs, and lost income. We can speak to that adjuster for you, protect your rights, and stop you from accepting a lowball offer.

The At-Fault Driver Is Uninsured or Underinsured

If the other driver lacks insurance or does not have enough coverage, your only option may be to use your own uninsured or underinsured motorist coverage in your policy. This claim often involves delays and resistance from your own insurer. We guide you through UM/UIM claims and push for full payment.

Deadlines Loom or Evidence Is Fading

Tennessee law gives you only one year to file a personal injury lawsuit after a car accident. Evidence such as skid marks, vehicle damage, roadway photos, or witness memories can disappear quickly. We move fast to preserve evidence and file any necessary court papers on time.

You Want a Better Settlement or Trial Representation

Insurance companies know that lawyers often get higher settlements. They may delay or undervalue your claim without legal pressure. We know the value of claims like yours. We negotiate aggressively. If needed, we will file suit and take your case to court.

Contact an Experienced Knoxville Car Accident Lawyer Today!

If you’ve been injured in a crash and are dealing with medical bills, lost wages, or a difficult insurance company, don’t try to handle it alone. Our team at Knoxville Car Accident Lawyer has the experience and knowledge to protect your rights and push back against low settlement offers.

Contact us at 864-444-2062 for a free claim review today!